Fastest Growing AI Discovery Platform. Submit Your AI Now!

Find out how a financial planner tool can make managing your money easier. These tools use AI to provide smart budgeting, investment advice, and personalized financial tips. Whether you want to save for retirement, track your daily spending, or explore new investments, these tools are here to help.

AI financial planner tools use advanced technology to analyze your finances and offer custom advice. Here’s how they work:

Budgeting Help: Track your income and expenses to create a clear budget.

Investment Tips: Get ideas for building and managing your investments.

Set Goals: Define and follow both short-term and long-term financial goals.

Expense Tracking: Spot areas where you can save more money.

Real-Time Updates: Stay updated on your financial progress with instant insights.

These AI tools, including financial planner online tools, make it easier to take control of your money.

Managing your money doesn’t have to be hard. A financial planner tool makes it simple by offering:

Time-Saving Features: Automate tasks like tracking expenses and creating budgets.

Accurate Calculations: Avoid mistakes in financial planning.

Organized Finances: Keep all your data in one place for easy access.

Better Decisions: Get advice based on data to guide your choices.

Affordable Options: Access tools that are cost-effective and reliable.

From planning daily budgets to big financial decisions, these tools are adaptable to your needs, whether you’re in India or elsewhere.

A financial planner tool is ideal for anyone looking to improve their wealth and finance:

Young Professionals: Get a head start on saving and investing.

Families: Plan household budgets and meet savings goals.

Business Owners: Manage business expenses and cash flow with ease.

Retirees: Organize savings for a comfortable retirement.

Investors: Boost returns with personalized advice.

Whether you’re searching for the best financial planner tools or need help with personal finances, these tools are perfect for all stages of life.

The best financial planner tools offer features that simplify money management, such as:

Track Spending: Keep tabs on your expenses and savings.

Reminders: Automate bill payments and stay on top of deadlines.

Custom Advice: Receive financial tips tailored to your situation.

Account Integration: Connect your bank, credit cards, and investment accounts.

Future Predictions: Plan ahead with tools that forecast your finances.

Secure Data: Enjoy peace of mind with advanced privacy and encryption features.

If you’re looking for an online financial planner tool, these features will meet your needs.

Getting started with a financial planner tool is simple:

Pick a Tool: Choose one that aligns with your goals.

Link Accounts: Connect your bank, credit cards, and investments.

Set Goals: Define what you want to achieve, like saving for a trip or paying off debt.

Review Advice: Look at the recommendations and adjust your plans.

Monitor Progress: Track your goals and refine your budget as needed.

With tools like personal financial planner tools, you can focus on your financial priorities.

Money management is key to reaching your goals, and financial planner tools make it easier. Here’s why they’re essential:

Easy to Use: Manage your finances from anywhere, anytime.

Personalized Help: Get advice that fits your unique situation.

Save Time: Automate time-consuming tasks like tracking and budgeting.

Stay Ahead: Plan for financial challenges before they happen.

Cost-Effective: Enjoy professional-level tools without breaking the bank.

Whether you’re new to financial planning or experienced, these tools offer practical solutions for everyone.

Take charge of your finances with our list of the best financial planner tools. From budgeting and saving to investing, these tools are designed to simplify your financial journey. Find the perfect solution to meet your goals today.

With options like financial planner tool India and global tools, managing your money has never been easier. Start planning for a brighter financial future now!

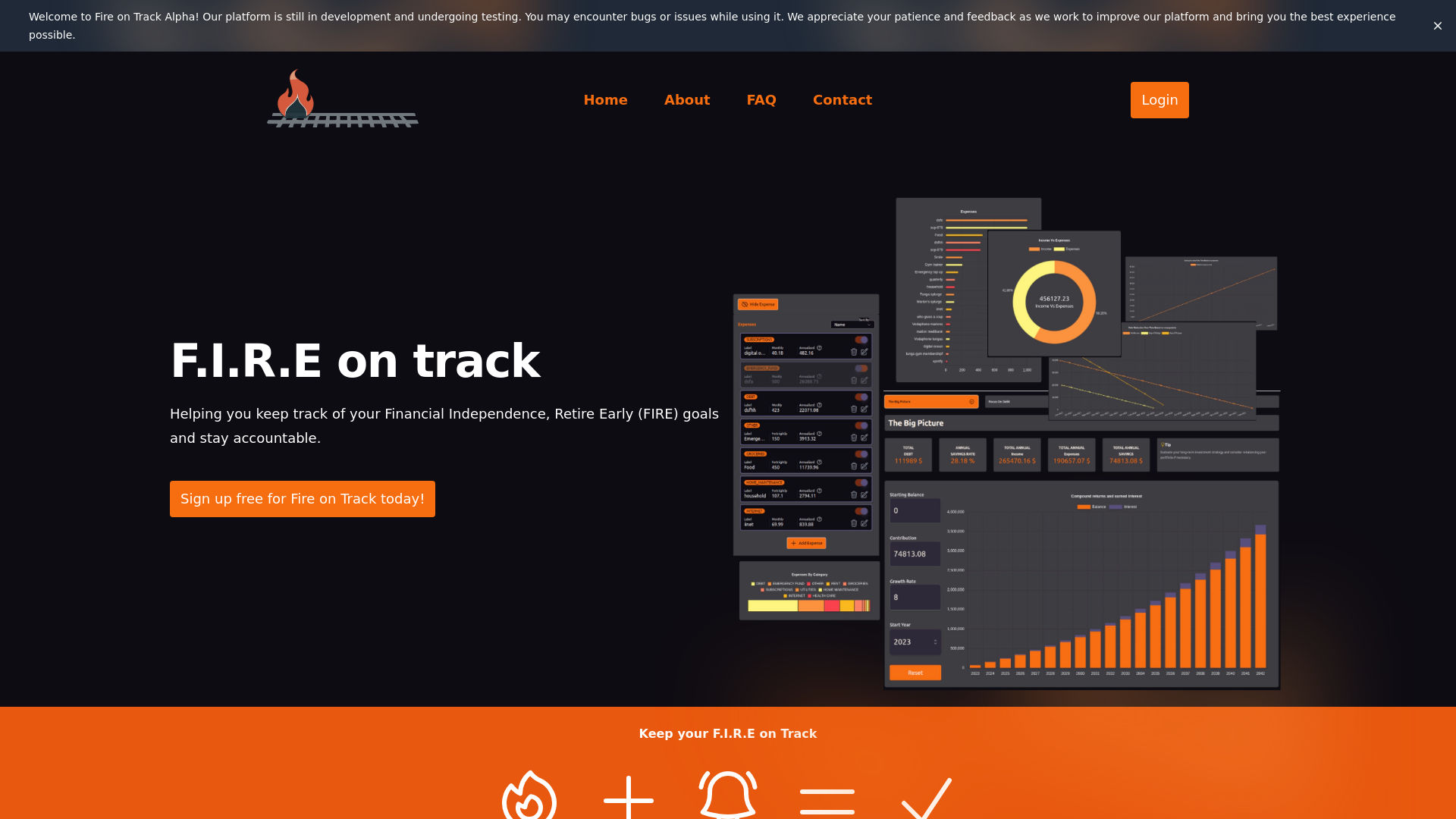

F.I.R.E On Track: AI financial advice Platform | ThatsMyAI

F.I.R.E On Track is an innovative platform designed to help individuals achieve financial independence and early retirement. Leveraging advanced AI te... Read More

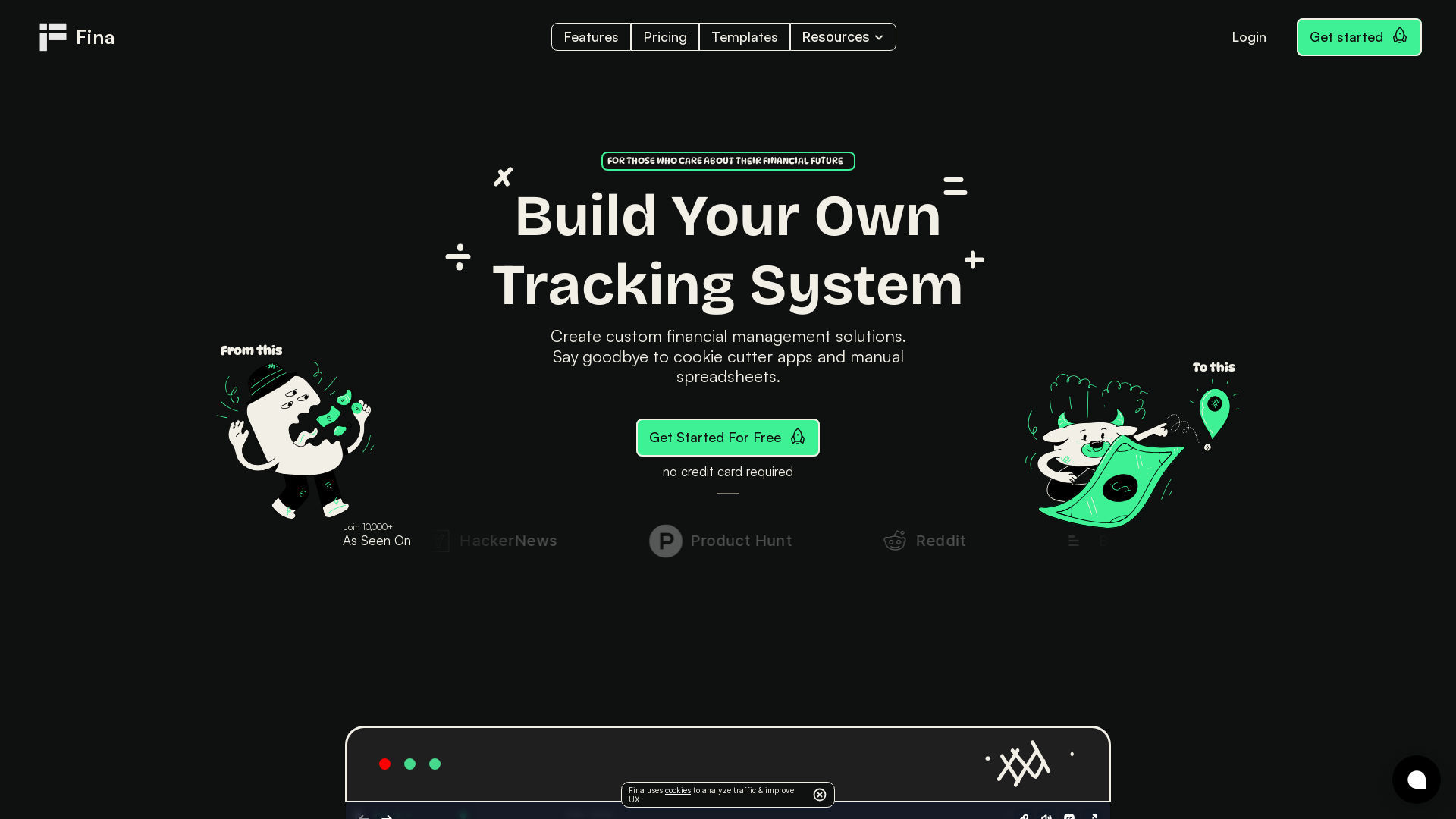

Fina: AI Powered financial advice Platform | ThatsMyAI

Fina is a cutting-edge AI-powered platform designed to revolutionize personal finance management. Utilizing advanced artificial intelligence, Fina pro... Read More

Monarch money: AI Powered Financial Advice Platform | ThatsMyAI

Monarch Money is an all-in-one personal finance platform designed to simplify and optimize financial management through advanced artificial intelligen... Read More

Octopus AI: AI Powered Financial Advice Platform | ThatsMyAI

Octopus AI leverages artificial intelligence in finance to provide real-time financial planning and analytics tailored for early-stage startups. Integ... Read More

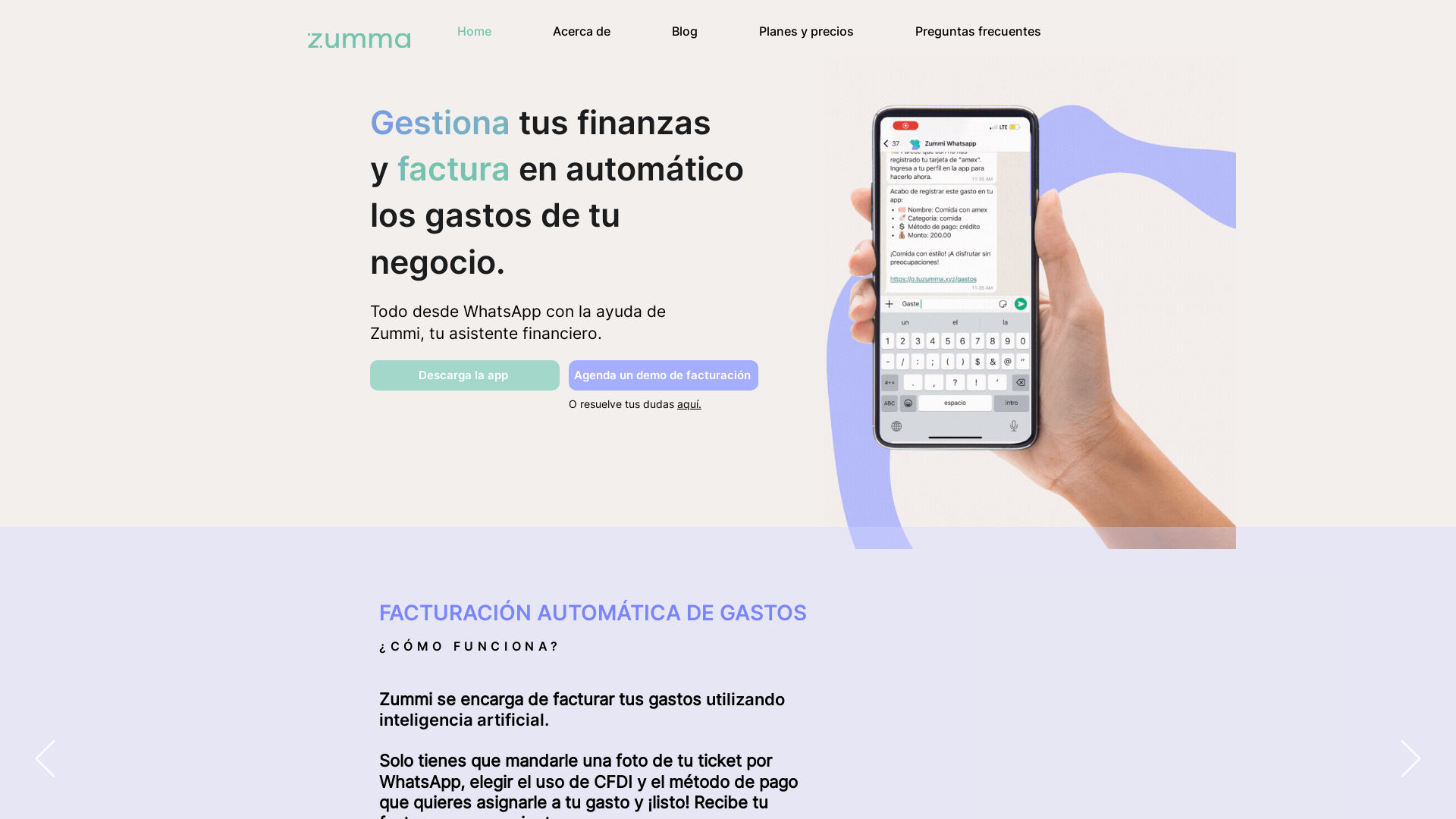

Zummafinancial: AI Powered financial advice Platform | ThatsMyAI

Zumma Financial revolutionizes expense management by leveraging artificial intelligence in finance. With Zumma, you can automatically generate invoice... Read More

Loading courses...

Loading...

Sign up to gain AI-driven insights and tools that set you apart from the crowd. Become the leader you’re meant to be.

Start My AI Journey

Learn how to integrate ChatGPT into your applications with personalized support from an AI mentor....

Chahe aap property dealer ho, doctor, kisaan, lawyer, teacher, vet doctor ya thekedar – AI...

Chahe aap school ke student ho, college mein ho ya competitive exams ki tayari kar...

Chahe aap ek homemaker ho, maa ho, housewife ho ya apne ghar aur परिवार को...

Learn how to build systems that learn, adapt, and evolve with a one-on-one AI-powered mentor,...

Excel in Marketing with AI: Master Automation, Personalization, and Data-Driven Strategies

.png?updatedAt=1728211623377)

Get ahead with a personalized learning experience driven by our AI mentor. Master smart ChatGPT...

Learn how to streamline operations with AI-driven automation. Your personalized AI mentor helps you apply...

Learn how to effectively communicate with AI systems by creating accurate and impactful prompts. Your...