Become more financially intelligent with AI tools on finance. These AI tools can help you manage your personal or business finances more effectively. Whether you need help budgeting, investing, tracking expenses, or financial planning for the future, these AI finance tools are here to assist. Designed to simplify money management, they make financial tasks easier and smarter. With AI, you can save time, make better financial decisions, and grow your wealth effortlessly.

These AI tools of finance are made to help you stay on top of your finances. They provide insights and support to help you make wise financial choices. By reducing stress and improving your overall financial health, these tools make managing money a breeze.

Best for: Personal finance management.

Why It’s Great: Fina Money offers smart budgeting features, helping users control their spending and save more. It’s one of the most effective tools on finance for individuals.

Best for: Investing insights.

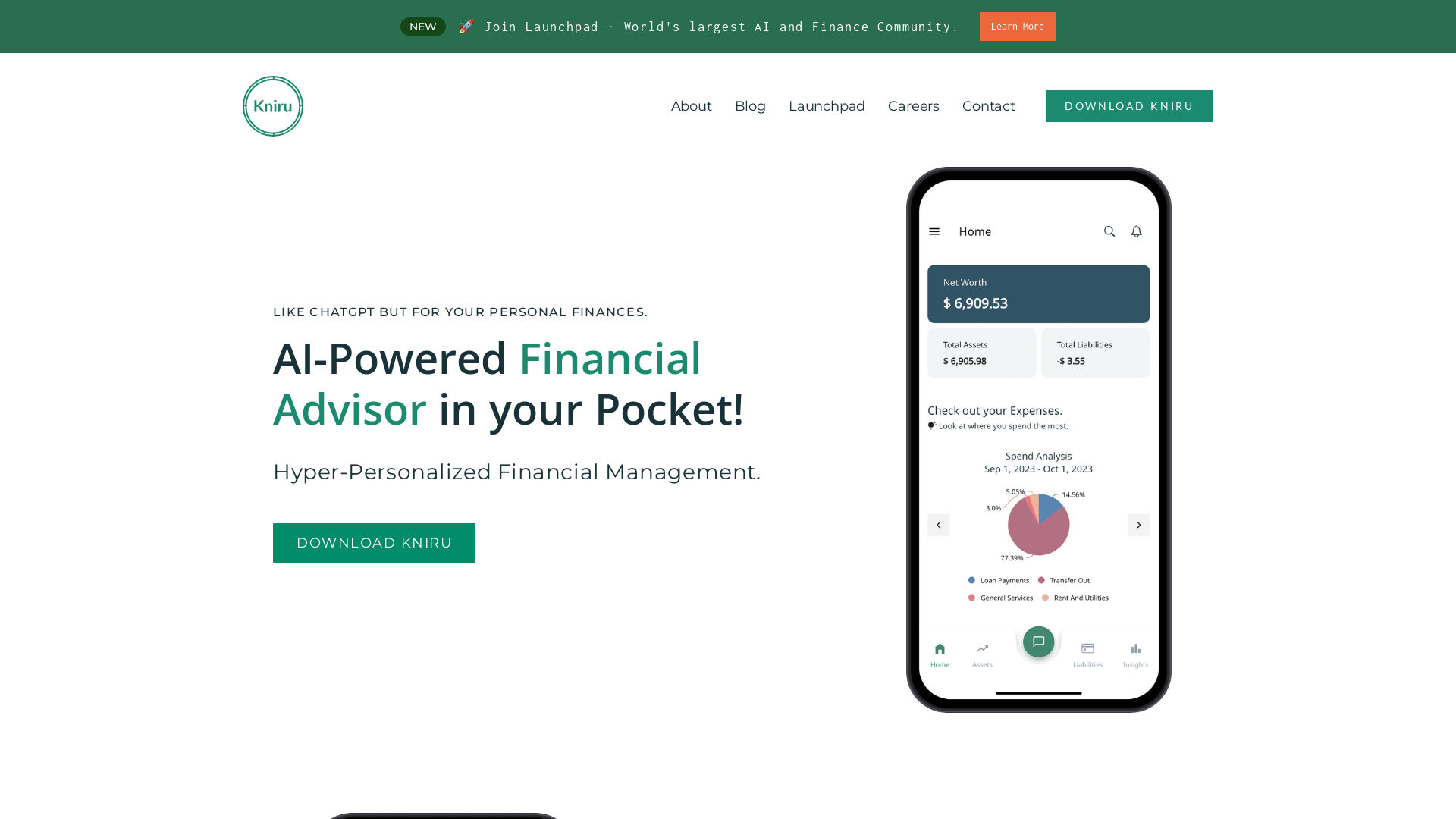

Why It’s Great: Kniru uses AI to analyze market trends and provide investment advice. It’s a go-to option for those seeking tools of finance for smarter investment strategies.

Best for: Business finance solutions.

Why It’s Great: Level Fields simplifies business expense tracking and forecasting. It’s perfect for managing budgets and predicting cash flow, making it one of the top tools on finance for businesses.

Best for: Automated financial planning.

Why It’s Great: Octopus AI offers features like expense categorization and personalized financial plans. It’s a great example of finance tools online that make managing money simple and efficient.

Best for: Stock market tracking.

Why It’s Great: Stock Near provides real-time updates on stock performance and trends. It’s one of the most reliable tools used in finance for active investors.

To pick the best AI finance tool for your needs, think about:

Personal vs. Business Needs: Are you managing your personal budget or running a business? Choose a tool that fits your specific financial situation.

Budgeting vs. Investing Goals: Decide whether your focus is on budgeting or growing wealth through investments. Some tools are better for tracking expenses, while others excel in market analysis.

Ease of Use: Look for tools that are simple to use. A user-friendly interface ensures you can start improving your finances without a steep learning curve.

AI tools on finance help you take control of your money by:

Automating Tasks: AI tools can track expenses, manage budgets, and even invest for you. They save time and reduce the stress of financial management.

Providing Clear Insights: Get a detailed view of your spending, saving, and investing habits. This helps you make better decisions about your money.

Offering Personalized Advice: AI tools analyze your financial data to give tailored suggestions that align with your goals, helping you make smarter choices.

Explore these AI tools of finance to find the best match for your needs. Whether you want to budget better, grow your investments, or manage business finances, these tools are here to help. From finance tools online to advanced systems, there’s a solution for everyone. Start using AI today to take charge of your finances and achieve your goals!

Loading courses...

Sign up to gain AI-driven insights and tools that set you apart from the crowd. Become the leader you’re meant to be.

Start My AI Journey

Learn how to integrate ChatGPT into your applications with personalized support from an AI mentor....

Chahe aap school ke student ho, college mein ho ya competitive exams ki tayari kar...

Chahe aap property dealer ho, doctor, kisaan, lawyer, teacher, vet doctor ya thekedar – AI...

Chahe aap ek homemaker ho, maa ho, housewife ho ya apne ghar aur परिवार को...

Learn how to build systems that learn, adapt, and evolve with a one-on-one AI-powered mentor,...

Excel in Marketing with AI: Master Automation, Personalization, and Data-Driven Strategies

.png?updatedAt=1728211623377)

Get ahead with a personalized learning experience driven by our AI mentor. Master smart ChatGPT...

Learn how to streamline operations with AI-driven automation. Your personalized AI mentor helps you apply...

Learn how to effectively communicate with AI systems by creating accurate and impactful prompts. Your...

Fina: AI Powered financial advice Platform | ThatsMyAI

Fina is a cutting-edge AI-powered platform designed to revolutionize personal finance management. Utilizing advanced artificial intelligence, Fina pro... Read More

Kniru: AI Powered financial advice Platform | ThatsMyAI

Kniru is an advanced AI-driven platform designed to revolutionize personal finance management. With Kniru, users can access hyper-personalized financi... Read More

LevelFields: AI Powered Stock Market Analysis Platform | ThatsMyAI

Trading Master is a state-of-the-art platform that leverages AI to enhance stock trading efficiency and profitability. Designed for both novice and ex... Read More